Global medical device testing market is expected to grow from USD 9.3 billion in 2020 to USD 11.8 billion by 2027

The growing trend of outsourcing medical device testing services and standards across medical devices are a few of the driving factors for the medical device testing market. Harmonization of standards, growing consumption of medical devices in emerging countries, increasing need for validation and verification for medical devices, imposition of stringent government regulations, the imposition of stringent government regulations, the imposition of stringent government regulations, the imposition of stringent government regulations, the imposition of stringent government regulations, the imposition of stringent government regulations, the imposition of stringent government The COVID-19 outbreak in 2019 emphasised the need for improved low-cost medical gadgets even more. Because these devices must adhere to severe medical device standards, manufacturers are spending a lot of time and money evaluating them.

During the projected period, the global medical device testing market is expected to rise at a CAGR of 4.8 percent, from USD 9.3 billion in 2020 to USD 11.8 billion in 2025.

The Impact of COVID-19 on the Medical Device Testing Market

The COVID-19 disaster has resulted in a worldwide health and economic crisis. As a result, some companies have shut down their manufacturing plants and halted most of their activities. During this situation, corporations’ primary goal is to keep their businesses afloat by either finding safe means to continue manufacturing activities or exploring other viable revenue streams. The need for medical device TIC services has always been high, as these services are critical in safeguarding customers from low-quality, dangerous medical devices all across the world. In the medical sector, the pandemic has raised demand for TIC services. For example, the current COVID-19 epidemic has raised demand for hygienic masks, and nations like France, Spain, and Mexico have established appropriate standards and specifications, such as the UNE 0065, UNE 0064-1, UNE 0064-2, and AFNOR-SPEC-S76, which must be met before a mask can be supplied. In addition, TIC market players that provide services to the medical industry have begun doing remote inspections of medical equipment in order to ensure health and safety compliance while avoiding any possible physical interaction.

Drivers The need for medical device validation and verification is growing.

Following COVID-19, manufacturing businesses throughout the world aim to spend more in automation, and the demand for automated quality assurance has grown as industries recognise its relevance in production processes. This need has been exacerbated by the COVID-19 outbreak, which has resulted in reduced human engagement in the process. As a result, machine vision is now widely accepted as an essential component of long-term automation development processes.

Obstacles to the development of medical equipment in the United States

While it is important to promote medical device standards and control, excessive regulations, particularly in the home setting, might function as a barrier to local device innovation. It has the potential to stifle domestic innovation by requiring new technology to go through a lengthy and costly licencing process, increasing the cost and time that local producers must pay in addition to the cost of manufacturing medical equipment. Due to the perceived hazards connected with their use, a few items that are of substantial benefit to low-income countries may be taken from the market.

Development of AI and IoT in various medical equipment is an opportunity.

The global medical device testing market is seeing a number of changes, including drug-device combinations, customised medicine, and increased adoption of various portable and wearable medical devices. A key development parameter for the worldwide medical device testing service market is technological improvements such as the incorporation of IoT and AI in various devices. Because these devices must adhere to strict rules, manufacturers are investing substantially in testing them.

Long lead time for abroad credentials is a challenge.

The time-consuming procedure of overseas acceptance of products affects the import and export of items in today’s globalised world, where countries are interdependent and engage in mutual trading and exchange of commodities and services. Due to the significant lead time required for international qualification tests, doing business in the overseas market is a key problem for enterprises. Risks such as customer loss, product quality, and time waste are likely to impair the functioning of enterprises as a result of delays in importing and exporting products. The time it takes for overseas qualifying tests to be completed must be reduced. As the number of impediments to international trade decreases, the time it takes to complete abroad qualification tests grows. As a result, in most applications, the long lead time for international qualification tests is a major challenge for the medical device testing business.

Testing Services had the biggest share of the global medical device testing market by service type in 2019.

Because of the growing demand for high-quality, standard products across the industry, TIC services in medical devices are in high demand. Testing services in the medical device testing market ensure that goods meet quality, safety, and performance regulatory standards. Electromedical device testing, biocompatibility testing, clinical research services reviewing the final product to explore the faulty material, and testing the performance of medical devices and the electrical safety of devices are only a few examples of testing services. Laboratories and research facilities provide testing services. Testing services help manufacturers improve the marketability of their medical devices while also cutting costs throughout the pre-production phase (e.g., R&D, supplier selection, etc.). Certification services, on the other hand, are expected to increase at a faster rate during the forecast period, as certifications ensure that medical product manufacturers adhere to quality and safety standards during the manufacturing process.

During the forecast period, outsourcing, by sourcing type, will increase at a faster CAGR.

Because growing restrictions make conducting in-house tests more expensive, many large companies are increasingly outsourcing medical device testing services, which helps them lower their overall testing costs.

Due to the capital-intensive nature of in-house TIC activities, the need for outsourcing TIC services to third-party vendors is increasing for technologies such as active implant medical devices. In 2019, however, in-house sourcing accounted for the majority of the worldwide medical device testing market.

Because of the related risk factor involved with these devices, there is a significant demand for class III medical devices.

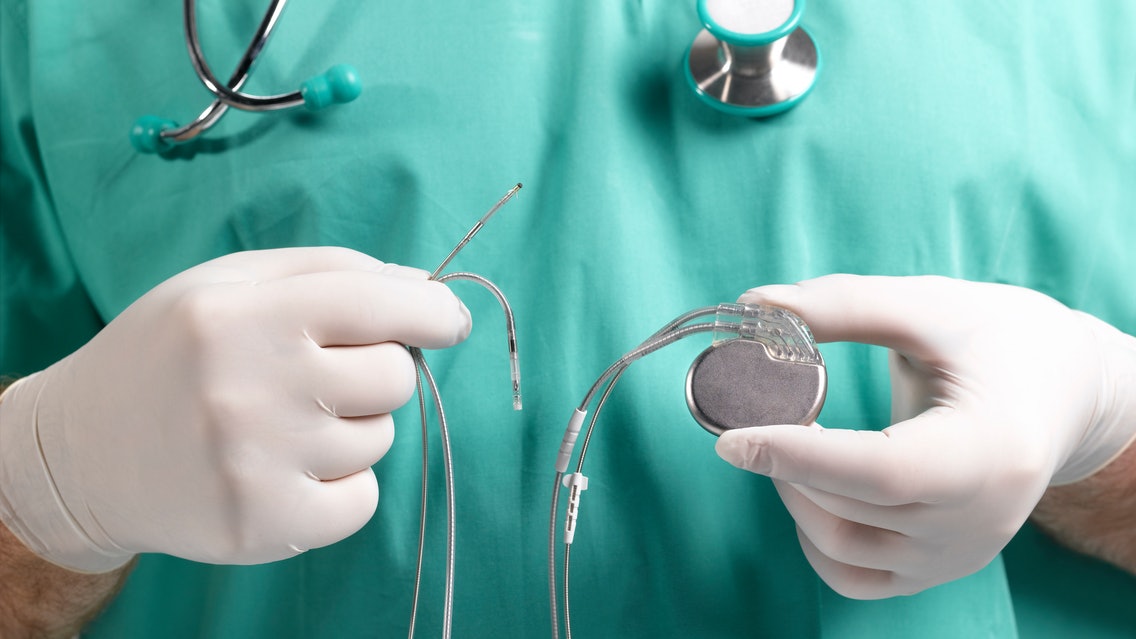

From 2020 to 2025, the class III medical device testing market is expected to develop at the fastest rate. Due to the presence of possible risks linked with medical devices and worried patients, there is a growing demand for classification of medical devices. Medical equipment classified as Class III are used to maintain or support human life. Class III devices are considered high-risk and are consequently subject to the most stringent regulatory oversight. Before being commercialised, Class III devices must usually be approved by the FDA. Replacement heart valves, implantable pacemakers, and pulse generators are all classified as Class III devices. In 2019, however, Class II devices accounted for the majority of the worldwide medical device testing market.

IVD offers substantial value to the treatment process and medical diagnostics, and is expected to dominate the medical device testing market by technology throughout the forecast period.

IVD brings substantial value to the therapy and medical diagnosis processes, improving public health at the same time. These devices aid in the detection of infections, the diagnosis of medical disorders, and the monitoring of pharmacological treatments. HIV hepatitis detection devices, infectious disease detection devices, blood glucose monitors, human leukocyte antigen detection devices, cancer markers, clinical chemistry devices, COVID-19 test kits, pregnancy test kits, coagulation test systems, urine test strips, and receptacles manufactured specifically for medical specimens are all examples of IVD medical devices. Active implant medical device technology, on the other hand, is expected to expand at a faster CAGR during the projected period due to its direct impact on personnel safety and health.

During the forecast period, Asia Pacific is expected to grow at the fastest rate.

Because of rising per capita income among the middle class in APAC, the medical device testing industry is quickly expanding. Furthermore, consumers are becoming more aware of the necessity of certification. During the projection period, India’s medical device testing market is expected to develop at the fastest rate. North America, on the other hand, has the highest share of the worldwide medical device testing market, owing to strict government regulations aimed at maintaining industry quality and safety standards, which promotes the demand for TIC services in the region.