Global Cryogenic Equipment Market To Witness Impressive Growth, Revenue To Surge To USD 29.4 Billion By 2028

From an anticipated USD 12.6 billion in 2020, the global cryogenic equipment market is expected to grow at a CAGR of 6.4 percent to USD 17.1 billion by 2025. The cryogenic equipment market is being driven by rising demand for industrial gases and investments in LNG infrastructure.

During the projected period, the tanks segment is expected to offer the most significant contribution to the cryogenic equipment market.

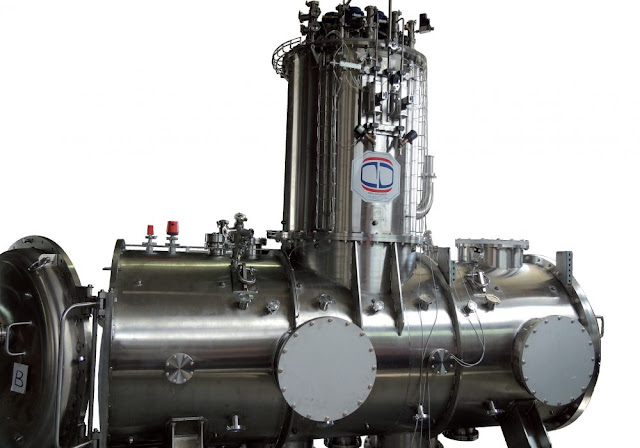

Liquefied industrial gases such as oxygen, hydrogen, nitrogen, helium, and argon are stored and transported in cryogenic tanks. It’s usually made to hold liquid gases at temperatures below -150°C. It’s available in a variety of shapes and sizes, including horizontal, vertical, double-walled, and insulated. It can be mobile or transportable, and it can be static or fixed. It is used in a variety of industries, including medical technology, food, electronics, and metal processing. It is commonly used to store LNG in LNG liquefaction plants and ships in the form of tankers.

The LNG segment is predicted to increase at the quickest rate among cryogens over the forecast period.

The demand for LNG is skyrocketing around the world. LNG trade increased by 9.8 percent year on year in 2018, according to the International Gas Union. To fulfil the rising demand for LNG, governments are making significant investments in LNG storage and regasification infrastructure. Two new regasification stations opened in Bangladesh and Panama in 2018. Tanks, vaporizers, valves, and heat exchangers are among the equipment needed for such infrastructure initiatives. As a result of these factors, cryogenic equipment for LNG is expected to increase at the highest CAGR of 7.8% throughout the projection period.

The Report Lists the Key Companies in the Long Term Care Insurance Market:

New York Life, Pacific Life, Lincoln Financial Group, Mutual of Omaha, Brighthouse Financial, OneAmerica Hybrid, GoldenCare, National Guardian Life, LTC Consumer, Minnesota Life, Transamerica, Nationwide, Thrivent, Bankers Life and Casualty, Prudential, UNUM, John Hancock, CNA, Genworth, AXA, State Life, and MassMutual.

The report provides a 360-degree overview of the market, listing various factors restricting, propelling, and obstructing the market in the forecast duration. The report also provides additional information such as interesting insights, key industry developments, detailed segmentation of the market, list of prominent players operating in the market, and other Long Term Care Insurance market trends. The report is available for sale on the company website.

Further, the report acknowledges that in these growing and promptly enhancing market circumstances, the most recent advertising and marketing details are very important to determine the performance in the forecast period and make essential choices for profitability and growth of the Long Term Care Insurance. In addition, the report encompasses an array of factors that impact the growth of the Long Term Care Insurance in the forecast period. Further, this specific analysis also determines the impact on the individual segments of the market.

Product Types: Between 18 and 64 ,Over 65 Years Old

On the Basis of Application: Traditional Long Term Care Insurance, Hybrid Long Term Care Insurance

Regional Analysis for Long Term Care Insurance Market :

- North America (the USA and Canada)

- Europe (UK, Germany, France, Italy, Spain, Scandinavia and Rest of Europe)

- Asia Pacific (Japan, China, India, Australia, Southeast Asia and Rest of Asia Pacific)

- Latin America (Brazil, Mexico and Rest of Latin America)

- Middle East & Africa (South Africa, GCC and Rest of the Middle East & Africa)

Major Table of Contents for Long Term Care Insurance Market :

1.Introduction

2.Executive Summary

3.Market Dynamics

4.Key Long Term Care Insurance Market Insights

5.Global Market Analysis, Insights and Forecast, 2015-2027

6.North America Market Analysis, Insights and Forecast, 2015-2027

7.Europe Market Analysis, Insights and Forecast, 2015-2027

8.Asia Pacific Market Analysis, Insights and Forecast, 2015-2027

9.The Middle East and Africa Market Analysis, Insights and Forecast, 2015-2027

10.Latin America Market Analysis, Insights and Forecast, 2015-2027

11.Competitive Landscape

12.Global Long Term Care Insurance Market Revenue Share Analysis, By Key Players, 2021

13.Company Profiles

14.Conclusion

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.